The bank for your crypto-assets

Whether you are an individual concerned about the security of your crypto-assets, a company looking for innovative investments or an institution wishing to benefit from our expertise and innovative solution, Banque Delubac & Cie can adapt to your needs.

Discover our solution for storing, buying, and selling your crypto-assets in a simple, secure way, with support throughout the process.

Join a

century-old

crypto-friendly bank

Expert and innovative

A century of financial expertise and 1st French DASP-registered bank.

Support and education

A selection of crypto-assets and a dedicated team to support you in investing in this new asset class.

Security and simplicity

Holding, buying and selling crypto-assets is as easy as managing your bank accounts.

A bank that suits your needs

Are you a company director, private individual or institutional investor?

We offer you personalised support.

Individuals

Would you like to invest in this new asset class and diversify your financial assets? Our experts and private bankers are here to support you.

Companies

Are you looking for innovative investment solutions for your cash management? Talk to experienced Pro & Business account managers.

Institutional

Benefit from our expertise and our innovative solution to enhance the value and competitiveness of your institution.

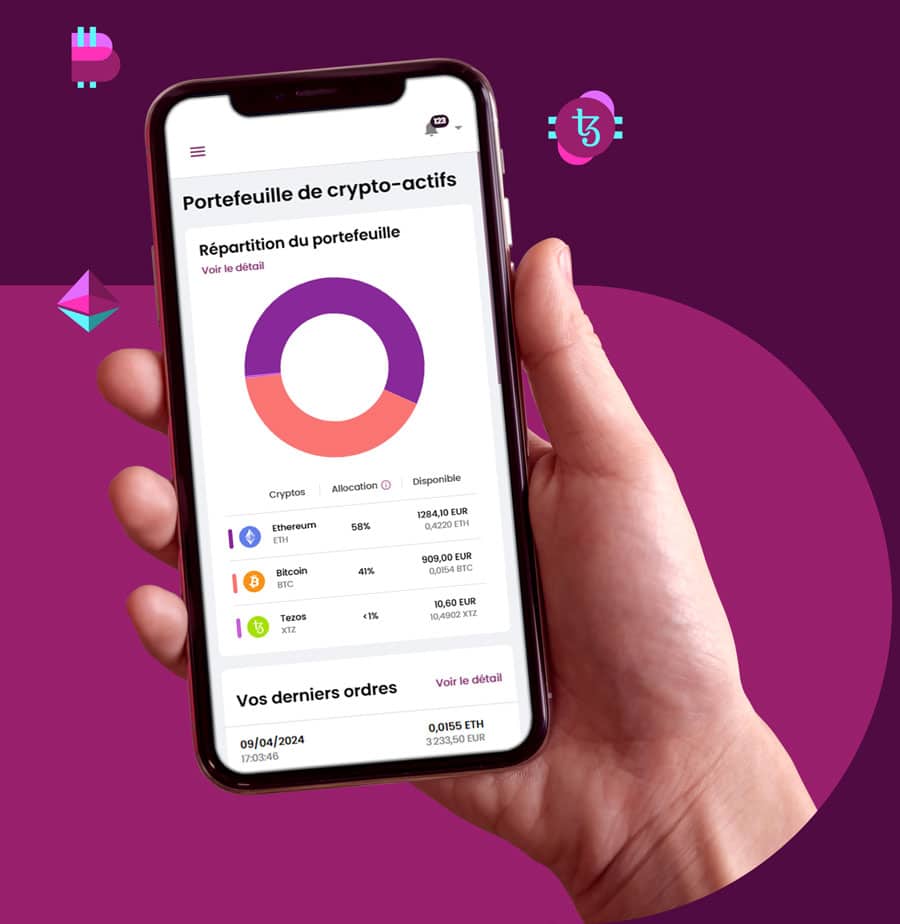

eDelubac, your simplified access to crypto

By opening a bank account with Banque Delubac & Cie, you can open and manage a crypto wallet. Convenient, simplified and highly secure access to this innovative new asset class.

From your computer, tablet or mobile, simply access your crypto wallet from your eDelubac space.

-

A single access point for managing all your accounts

-

A simple, intuitive interface for managing your crypto-assets

-

Segregation of your accounts and your crypto wallet

A pre-selection of crypto-assets for you

Within your eDelubac space, we have carefully selected a number of crypto-assets to enable you to invest with simplicity and confidence. Our approach facilitates your investment process, while ensuring that transactions are compliant and protected

Storing in France your crypto-assets

In an ecosystem where fraud and deception are commonplace, many investors fear losing their private keys or falling victim to hacking, and often feel dissatisfied with current solutions, deeming them insecure or too complex.

With Banque Delubac & Cie, you don’t need to be a security expert to keep your crypto-assets safe. Your crypto accounts are stored in France and are not exposed to exchange platforms.

The latest news on crypto-currencies

Appointment of Xavier Gomez to the Supervisory Board of Banque Delubac & Cie

A recognized figure in finance and Web3, co-founder and CEO of Invyo, Xavier Gomez joins…

Web 3 and Crypto in France and Europe: Continued Adoption and Growth of the Sector (2024 Edition)

Adan (the Association for the Development of Digital Assets), KPMG France, and Ipsos have just…

Web3 and Crypto: Trust for Adoption

Watch a video of Joël-Alexis Bialkiewicz, managing partner at Banque Delubac & Cie, speaking at…

Investing in digital assets involves risks and is not suitable for all investors.

Investors should inform themselves about the risks associated with the various digital assets. In particular, it is emphasised that digital assets can be highly volatile and that investments in digital assets present a risk of capital loss. In this respect, investors are reminded that past performance of digital assets, which may be indicated on the Banque Delubac & Cie website or in documents made available to investors, is not representative of future performance. In addition, investors should inform themselves about the technologies related to each digital asset and their risks, like flaws, defects, piracy, errors, protocol failures or attacks thereon. Banque Delubac & Cie cannot be held responsible for any misunderstanding of the risks associated with digital assets or for any losses that the investor may incur in the event of an error in the address of the portfolio attributable to the investor.

Banque Delubac was the subject of a “simple” registration subject to the provisions of article L. 54-10-3 of the Monetary and Financial Code in force before 1 January 2024 and was not subject to the provisions relating to the “enhanced” registration introduced by the law of 9 March 2023.

During this registration procedure, the Autorité des marchés financiers (Financial Markets Authority) verified:

- The integrity and competence of the managers and beneficial owners,

- The ability of the Service Provider to comply with its obligations in terms of the fight against money laundering and terrorist financing, the freezing of assets and the prohibition on making assets available, by putting in place an organisation and procedures.