Are cryptocurrencies taxable? Tax guide 2024 in France

As the crypto microcosm continues to evolve, one burning question keeps coming up: are cryptocurrencies taxable? In 2024, this question is no longer just a curiosity for technology enthusiasts, but a concrete reality for investors, traders and individuals.

Summary

- What will cryptocurrency taxation look like in 2024?

- Reporting requirements for cryptocurrency accounts

- Why will the taxman soon have access to all your cryptocurrency transactions via platforms?

- The Flat Tax: impact on the taxation of cryptocurrencies

- Taxation of cryptocurrencies: capital gains and trading

- In conclusion

- Frequently asked questions

To give you a brief answer, capital gains in excess of €305 a year have been taxable since 2019. But how does this work and what’s new this year? With the growing adoption of cryptocurrencies like Bitcoin, EthereumSecond most important crypto asset by market capitalization. Ethereum blockchain has been launched

in 2015 by Vitalik Buterin, it is also used for other applications such as DeFi and NFTs. Lire la suite, and other Altcoins, understanding their taxation in France has become essential.

This article aims to demystify the complexities of cryptocurrency taxation, exploring recent changes, reporting obligations, the impact of Flat Tax, and the nuances of cryptocurrency trading. Get ready to dive into the maze of tax regulations and finally see clearly!

| Tax aspects | Description | Impact on users |

| Taxation of cryptocurrencies in 2024 | Update on tax regulations concerning cryptocurrencies in France. | Need for users to understand the new rules. |

| Reporting obligations | Requirement to report cryptocurrency accounts and transactions. | The importance of transparency and tax compliance. |

| Flat tax on crypto gains | Application of a Flat Tax of 30% (income tax and social security contributions) on gains. | Simplified tax calculation for investors. |

| Capital gains and trading | Specific tax regime for capital gains and cryptocurrency trading. | Need to document and declare gains accurately. |

| Practical implications | Consequences of non-compliance and the importance of proper documentation. | Risk of penalties for failure to declare; need for organisation. |

What will cryptocurrency taxation look like in 2024?

Understanding crypto tax

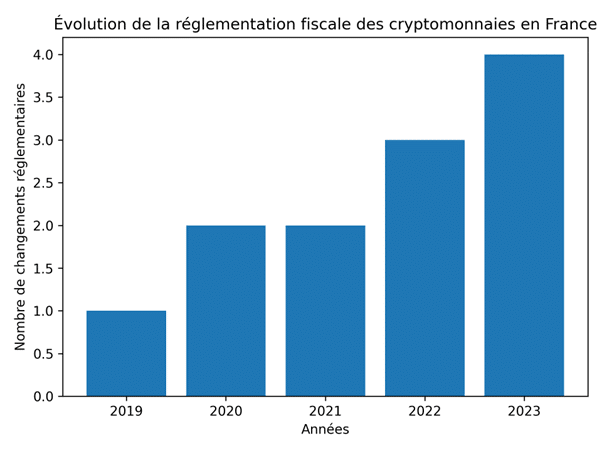

In 2023, the taxation of cryptocurrencies in France continued to evolve, reflecting the growing importance of these digital assets. France, along with the European Union, has sought to clarify and regulate the taxation of cryptocurrencies such as Bitcoin, Ethereum, Altcoins, and even NFTs and stablecoins. The French tax authorities are adapting to incorporate these assets into the existing tax framework.

Taxation of cryptocurrencies is now a reality for investors and users. The General Tax Code, in particular Articles 150 VH and 200 C, sets out the rules for taxing gains made on cryptocurrencies. Understanding these rules is crucial for individuals and investors to comply with tax requirements.

Anticipating the 2024 changes in cryptocurrency taxation

With the entry into force of Article 79 of the Finance Act 2022, significant changes have been made to the taxation of cryptocurrencies. From 1 January 2023, the rules on crypto-crypto transactions and the declaration of gains have been adjusted. These changes are designed to simplify reporting and provide a better framework for the cryptocurrency market.

Non-commercial profits (BNC) and industrial and commercial profits (BIC) are two key categories in determining the taxation applicable to cryptocurrency-related activities. The distinction between these two regimes is essential for taxpayers who need to declare their cryptocurrency gains.

Recognition of cryptocurrencies as digital assets and their tax implications

The official recognition of cryptocurrencies as digital assets has important implications for users and exchangeExchange platform for crypto assets (Binance, Kraken…) Lire la suite platforms such as Coinbase, Kraken, Binance, etc. This recognition means that all transactions, including the exchange of cryptocurrencies for other cryptocurrencies or for legal tender, are subject to taxation.

Social security contributions and income tax are payable on gains. Users must use the Cerfa 2042 and Cerfa 3916 forms to declare their accounts and transactions. Failure to do so may result in a tax adjustment.

Reporting requirements for cryptocurrency accounts

Declaring your Binance account or other platforms for tax purposes

In 2023, France tightened its requirements for declaring cryptocurrency accounts. Every cryptocurrency holder must declare their accounts on exchange platforms, such as Coinbase, Kraken, or Binance. This obligation is part of an approach to transparency and tax compliance.

To comply, users must complete the Cerfa 3916 bis form specific to digital asset accounts. This form enables the tax authorities to track cryptocurrency transactions and holdings, ensuring better regulation of the market.

Legal obligations and trading platforms concerned

The legal obligations extend to all trading platforms operating in France and the European Union. Users must declare not only accounts held on French platforms, but also those held abroad. This measure is designed to prevent tax evasion and ensure fair taxation of cryptocurrency gains.

Exchange platforms are also required to comply with French and European regulations, particularly in terms of the fight against money laundering and the financing of terrorism. They must provide the tax authorities with all the necessary information about their users’ accounts and transactions.

Consequences of non-declaration and compliance measures

Failure to declare cryptocurrency accounts can result in severe sanctions, including fines and penalties. The French tax authorities have put in place measures to encourage compliance, including informing taxpayers about reporting procedures and offering assistance in completing the necessary forms.

It is crucial for cryptocurrency holders to keep abreast of the latest legislative and tax developments to avoid any risk of non-compliance. Declaring cryptocurrency accounts is an essential step in ensuring the transparency and security of the digital asset market.

In conclusion, the reporting requirements for cryptocurrency accounts are a key part of the regulation of the cryptocurrency market in France. They aim to ensure fair taxation and prevent the risks associated with tax fraud and money laundering.

Why will the taxman soon have access to all your cryptocurrency transactions via platforms?

Tax authorities’ access to your crypto-assetDigital asset based on cryptography principles. Peer to peer traded, on a decentralized network, thanks to Distributed Ledger Technologies such as blockchain. The user is integrated into storage and transaction Lire la suite transactions via platforms is part of a growing global trend towards tax regulation and oversight of digital assets. This is driven by the desire of tax authorities to combat tax evasion, money laundering, and ensure greater financial transparency. As cryptocurrencies grow in popularity and legitimacy, governments are looking to integrate these assets into existing regulatory frameworks.

As a result, cryptocurrency exchange platforms are increasingly required to share user information with tax authorities. For cryptocurrency investors, it is essential to stay informed about the tax legislation in force in their country and to report their transactions and gains in accordance with local laws.

It may be wise to consult a tax expert specialising in cryptocurrencies to fully understand your tax obligations and avoid potential penalties. Transparency and prudence are the keys to successfully navigating the ever-changing cryptocurrency tax landscape.

The Flat Tax: impact on the taxation of cryptocurrencies

Flat Tax, or Prélèvement Forfaitaire Unique (PFU), is a simplified tax system introduced in France. In 2024, this tax system will also apply to gains made on cryptocurrencies. With a flat rate of 30%, the Flat Tax combines income tax and social security deductions.

This measure aims to simplify the taxation of cryptocurrency gains, making the process more transparent and manageable for taxpayers. It applies to the majority of cryptocurrencies, including Bitcoin, Ethereum, and various Altcoins.

Advantages and limitations of Flat Tax for crypto investors

The introduction of Flat Tax offers several advantages for cryptocurrency investors. It allows for more predictable taxation and reduces administrative complexity. However, it is important to note that this tax only applies to gains made, not the total value of the crypto portfolio.

However, some investors may find the 30% rate relatively high, especially when compared with the tax regimes in some other EU countries. In addition, this tax does not take into account potential losses, which could be a disadvantage for active traders.

Details of the single-rate withholding tax (PFU) for crypto gains

The 30% PFU breaks down into two parts: 12.8% for income tax and 17.2% for social security contributions. This tax applies to gains made when cryptocurrencies are sold for legal tender or when cryptocurrencies are used to purchase goods or services.

It is essential for cryptocurrency holders to properly document all their transactions to facilitate tax reporting and calculation. Exchange platforms often provide detailed statements that can be used for this purpose.

Taxation of cryptocurrencies: capital gains and trading

Global approach to cryptocurrency tax calculation

In 2023, the taxation of cryptocurrencies in France continued to evolve, with a particular focus on capital gains and trading. When an investor makes a gain from selling their cryptocurrencies, that gain is subject to taxation. The tax calculation takes into account the difference between the sale price and the purchase price, thus constituting a capital gain.

Tax regime applied to crypto capital gains

Capital gains made on cryptocurrencies are taxed under the Flat Tax regime at 30%, which includes income tax and social security deductions. This regime applies to sales of cryptocurrencies against legal tender currencies or against other cryptocurrencies.

It is important for taxpayers to declare all their cryptocurrency transactions, including crypto exchanges, to comply with tax requirements. Exchange platforms generally provide the necessary information to facilitate this declaration.

Tax aspects of cryptocurrency trading

Cryptocurrency trading has some unique tax peculiarities. Active traders, who frequently buy and sell cryptocurrencies, need to be particularly vigilant in managing their tax obligations. Gains made are considered non-commercial profits (BNC) or industrial and commercial profits (BIC), depending on the volume and frequency of transactions.

Calculating and declaring trading gains

To declare gains from cryptocurrency trading, investors should use the Cerfa 2042 and Cerfa 3916 forms. It is crucial to keep a detailed history of all transactions, including purchase and sale dates, purchase and sale prices, and transaction feesFees related to operations; they sometimes are distributed to miners. Lire la suite, for accurate calculation of capital gains.

In conclusion

Navigating the waters of cryptocurrency taxation can feel like a journey through a complex maze of regulations and directives. In 2023, France took significant steps to clarify and structure the taxation of cryptocurrencies, providing investors and users with a better understanding of their tax obligations.

Whether it’s through understanding Flat Tax, declaring cryptocurrency accounts, or calculating capital gains from trading, staying informed and compliant is crucial to making the most of your investments.

So if you were wondering whether cryptocurrencies were taxable, the answer is clearly yes. And with the information provided in this article, you are now better equipped to approach this tax reality with confidence and serenity.

Frequently asked questions

Are cryptos taxable?

Taxation of cryptocurrencies varies considerably between jurisdictions, but in many countries, gains made on cryptocurrency transactions are effectively taxable.

Typically, profits from the purchase and sale of cryptocurrencies, or gains from miningProcess allowing to solve a mathematical or computing challenge imposed by a blockchain’s Proof of Workconsensus. Mining activity requires a variable calculation power depending on the blockchain’s algorithm alongwith difficulty Lire la suite or stakingImmobilizing crypto assets on a given period while receiving interests. Lire la suite, are subject to capital gains tax, similar to other forms of investment.

It is crucial for cryptocurrency investors to keep abreast of their country’s specific tax laws regarding digital assets.

How much is trading taxable?

The taxation of trading, including cryptocurrency trading, depends largely on the specific tax legislation of each country. In general, gains from trading are subject to tax once they exceed a certain threshold, which varies from jurisdiction to jurisdiction.

For example, some countries may apply a tax exemption up to a certain amount of annual earnings, beyond which taxation becomes applicable.

It is essential for traders to familiarise themselves with the capital gains tax laws of their country of residence, including any exemptions and tax thresholds.

How do you declare your cryptos for tax purposes?

To declare your cryptocurrencies for tax purposes, it’s vital to follow a rigorous process that complies with your country’s tax regulations. First of all, make sure you understand the tax laws relating to cryptocurrencies in your jurisdiction, as they can vary considerably from country to country.

Typically, this involves reporting capital gains made on cryptocurrency transactions, which may be considered taxable capital gains.

It is important to keep accurate and detailed records of all your transactions, including dates, amounts bought and sold, and any gains or losses made. This information is crucial for calculating your tax obligations correctly.

In many countries, tax return forms now include specific sections for digital assets. Make sure you complete these sections in line with your transactions for the tax year. If the process seems complex or if you have made a large number of transactions, considering an accountant or tax advisor who specialises in cryptocurrencies may be a wise decision.

Investing in digital assets involves risks and is not suitable for all investors.

Investors should inform themselves about the risks associated with the various digital assets. In particular, it is emphasised that digital assets can be highly volatile and that investments in digital assets present a risk of capital loss. In this respect, investors are reminded that past performance of digital assets, which may be indicated on the Banque Delubac & Cie website or in documents made available to investors, is not representative of future performance. In addition, investors should inform themselves about the technologies related to each digital asset and their risks, like flaws, defects, piracy, errors, protocol failures or attacks thereon. Banque Delubac & Cie cannot be held responsible for any misunderstanding of the risks associated with digital assets or for any losses that the investor may incur in the event of an error in the address of the portfolio attributable to the investor.

Banque Delubac was the subject of a “simple” registration subject to the provisions of article L. 54-10-3 of the Monetary and Financial Code in force before 1 January 2024 and was not subject to the provisions relating to the “enhanced” registration introduced by the law of 9 March 2023.

During this registration procedure, the Autorité des marchés financiers (Financial Markets Authority) verified:

- The integrity and competence of the managers and beneficial owners,

- The ability of the Service Provider to comply with its obligations in terms of the fight against money laundering and terrorist financing, the freezing of assets and the prohibition on making assets available, by putting in place an organisation and procedures.